On April 2, 2024 the Manitoba Minister of Finance announced the province’s 2024 budget. This article highlights the most important things you need to know about this budget, broken into 2 sections:

-

Personal Tax Changes

-

Business Tax Changes

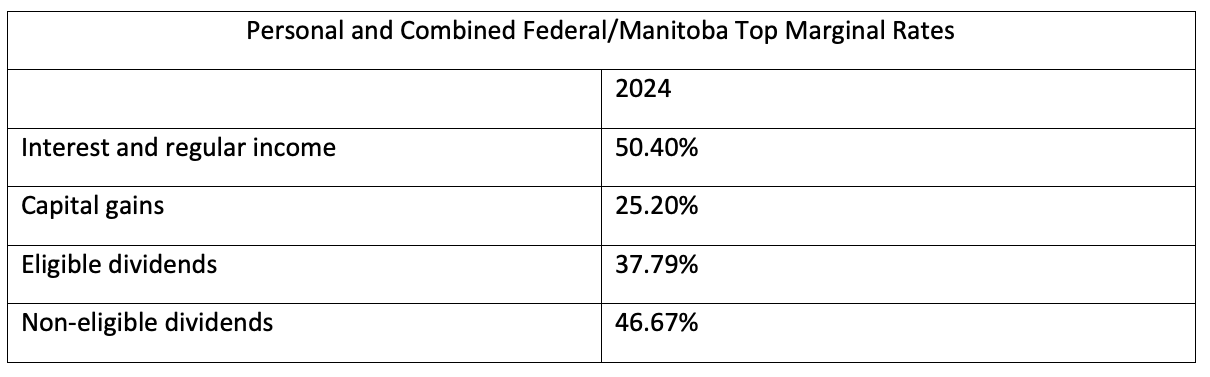

Personal tax changes

There are no changes to the province’s personal tax rates in Budget 2024.

As a result, Manitoba’s personal income tax rate remains as follows:

Basic Personal Amount

Starting from the year 2025, people earning between $200,000 and $400,000 may see a reduction in the Basic Personal Amount they can claim on their taxes.

Renters Tax Credit

The budget boosts the Renters Tax Credit to a maximum of $575 (up from $525) and increases the additional support for low-income seniors to $328 (up from $300), starting in the 2025 tax year.

School Tax-Related Credits

The budget gets rid of the School Tax Rebate and Education Property Tax Credit for the 2025 tax year as part of changing how this tax system works. Also, it ends some school tax-related benefits for seniors like the Education Property Tax Credit senior’s top-up and the School Tax Credit but keeps the Seniors School Tax Rebate. Manitoba also says it will stop giving the School Tax Rebate for commercial properties, except for farms, which will still get a 50% rebate.

Homeowners Affordability Tax Credit

The budget brings in a new Homeowners Affordability Tax Credit starting in 2025. This credit, worth up to $1,500 for main homes, aims to replace the School Tax Rebate and Education Property Tax Credit. It’ll be subtracted directly from the property tax bill.

Fertility Treatment Tax Credit

The budget improves the Fertility Treatment Tax Credit for the 2024 tax year. It raises the highest yearly allowable expense to $40,000 (up from $20,000), and the yearly credit available to $16,000 (up from $8,000).

Gas Tax

The budget prolongs the temporary gas tax reduction until September 30, 2024, which was previously set to end on June 30, 2024. This means that there will still be no tax charged on gasoline, diesel, and marked gasoline until this new date.

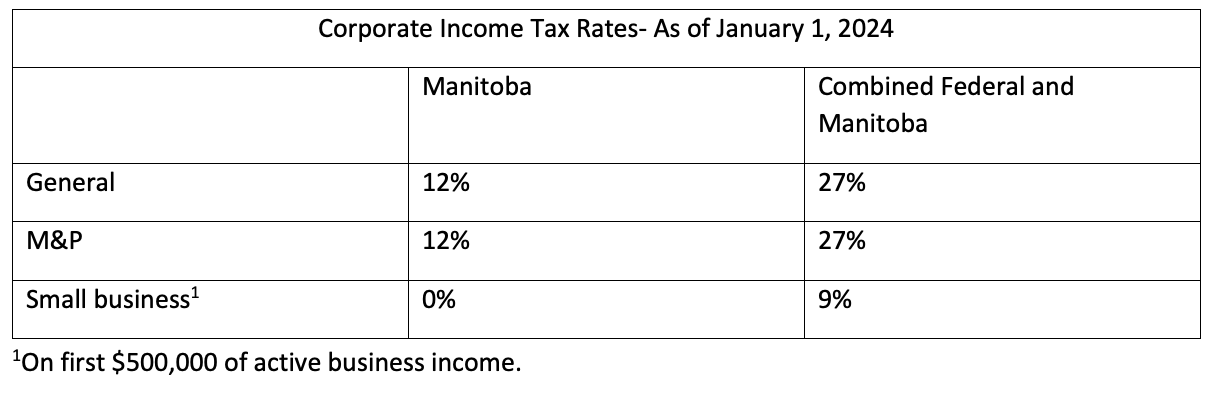

Business tax changes

There are no changes to the province’s corporate tax rates in Budget 2024.

As a result, Manitoba’s Corporate income tax rate remains as follows:

1On first $500,000 of active business income.

Data Processing Investment Tax Credit

The budget gets rid of the Data Processing Investment Tax Credits for the 2025 tax year.

Sales Tax Registration

The budget raises the sales tax registration threshold to $30,000 of taxable sales starting from January 1, 2024, up from the previous $10,000. Manitoba wants its rules to match the federal $30,000 GST/HST registration threshold.

Sales Tax Commissions

The budget removes sales tax commissions for businesses that report less than $3,000 in sales tax in any filing period ending after April 2024.

Rental Housing Construction Tax Credit

The budget introduces a Rental Housing Construction Tax Credit. This credit gives $8,500 for building new market-rate rental homes and $13,500 for homes kept affordable for at least 10 years. Non-profit groups get a full refund, while other businesses can get $8,500 back for all homes. Additionally, there’s a $5,000 credit over 10 years for affordable homes. Construction must start on or after January 1, 2024, to qualify.

We can help!

Wondering how this year’s budget will impact your finances or your business? We can help – give us a call today!